Paycheck calculator with overtime and bonus

Overtime payments are commonly called the overtime premium or the overtime rate of payThe most usual rate for overtime hours is time and a half and that is 50 more. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

9 Best Free Paycheck Calculator Online Amazon Seller News Today

Ad Learn How To Make Payroll Checks With ADP Payroll.

. Ad Payroll So Easy You Can Set It Up Run It Yourself. In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15 overtime hours paid as double time the following figures will result. Free salary hourly and more paycheck calculators.

Get 3 Months Free Payroll. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Ad Compare This Years Top 5 Free Payroll Software.

Ad Learn How To Make Payroll Checks With ADP Payroll. For example if you worked 48 hours in a week your base hourly rate is 12 per hour and you. Then multiply that number by the total number of weeks in a year 52.

Overtime pay per period. DOL is raising the total. There are two ways to calculate taxes on bonuses.

Exempt means the employee does not receive overtime pay. If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime. So your big Texas paycheck may take a hit when your property taxes come due.

Multiply the hourly wage by the number of hours worked per week. Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator Enter your bi-weekly gross to calculate your annual salary. FLSA Overtime Pay Computation for AUO Employees.

Get 3 Months Free Payroll. Get 3 Months Free Payroll. To try it out enter the.

This federal hourly paycheck. In the event of a conflict between the information from the Pay Rate Calculator and. Ad Compare This Years Top 5 Free Payroll Software.

How You Can Affect Your Texas Paycheck. Thats equivalent to 35568 per year for a full-year worker. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

You can claim overtime if you are. Fast Easy Affordable Small Business Payroll By ADP. The calculator on this page uses the percentage method which calculates.

Get 3 Months Free Payroll. The percentage method and the aggregate method. All Services Backed by Tax Guarantee.

Read reviews on the premier Time Clock Tools in the industry. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after. Get an accurate picture of the employees gross pay including.

Free Unbiased Reviews Top Picks. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

In one of three recent opinion letters the Department of Labor DOL explained how to calculate overtime pay for bonuses given for the completion of training over a period. Free Online Paycheck Calculator for Calculating Net Take Home Pay. Then take that total and divide it by the total number of hours worked that week.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. Fast Easy Affordable Small Business Payroll By ADP.

It can also be used to help fill steps 3 and 4 of a W-4 form. Ad See the Time Clock Tools your competitors are already using - Start Now. If you want to boost your paycheck rather than find tax.

DOL is increasing the standard salary level thats currently 455 per week to 684 per week. For example if an employee makes 25 per hour and. Get an accurate picture of the employees gross.

The overtime calculator uses the following formulae. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

Free Unbiased Reviews Top Picks. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Federal Bonus Tax Percent Calculator.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

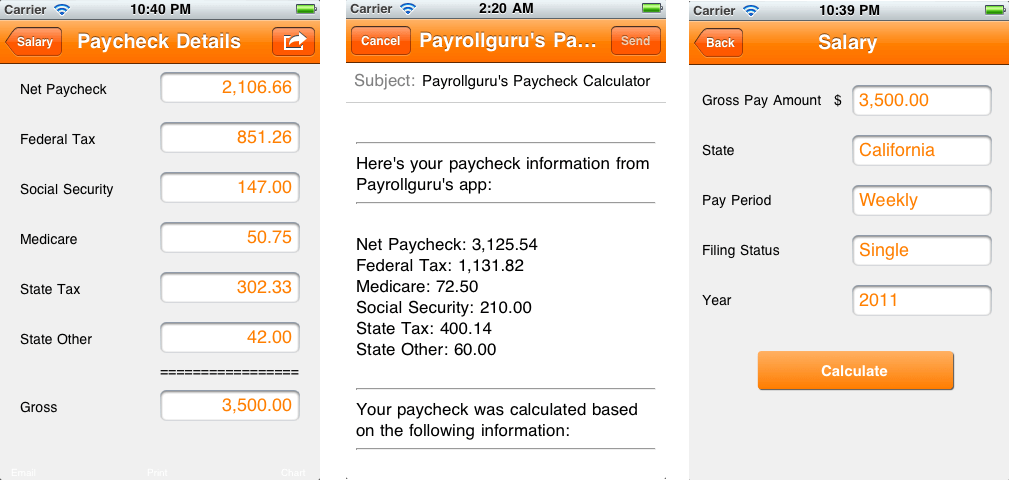

9 Best Free Paycheck Calculator Online Amazon Seller News Today

9 Best Free Paycheck Calculator Online Amazon Seller News Today

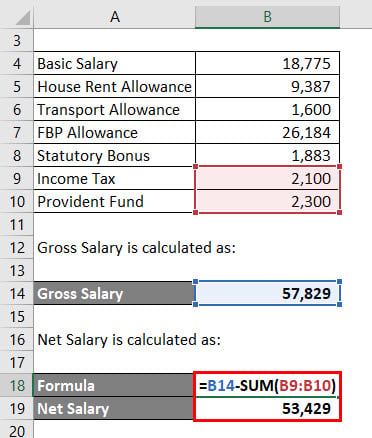

Payroll Calculator Free Employee Payroll Template For Excel

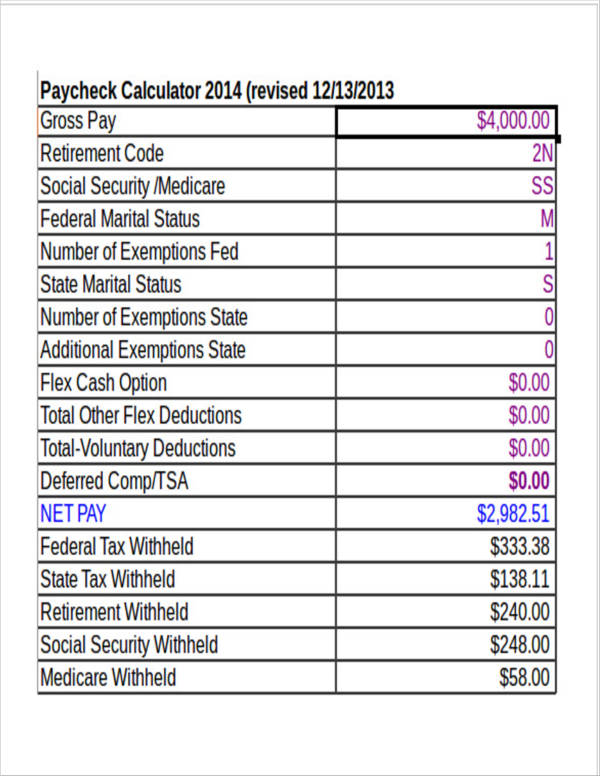

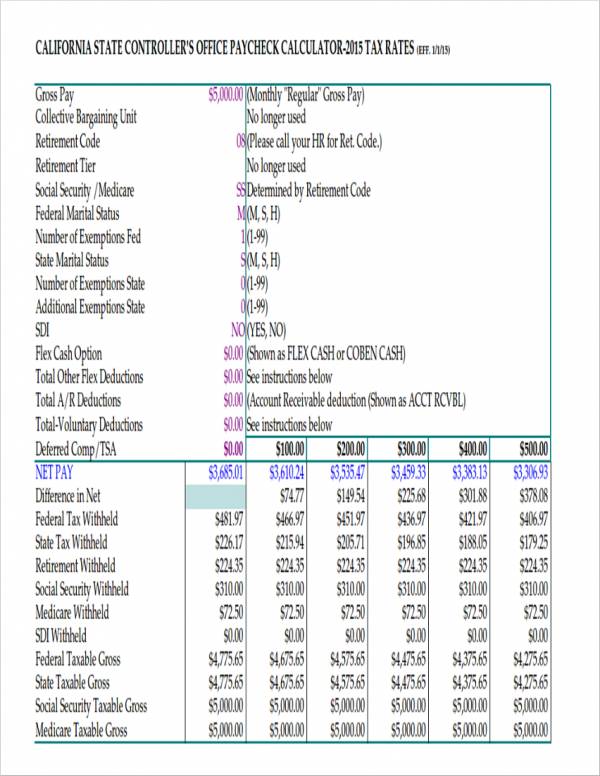

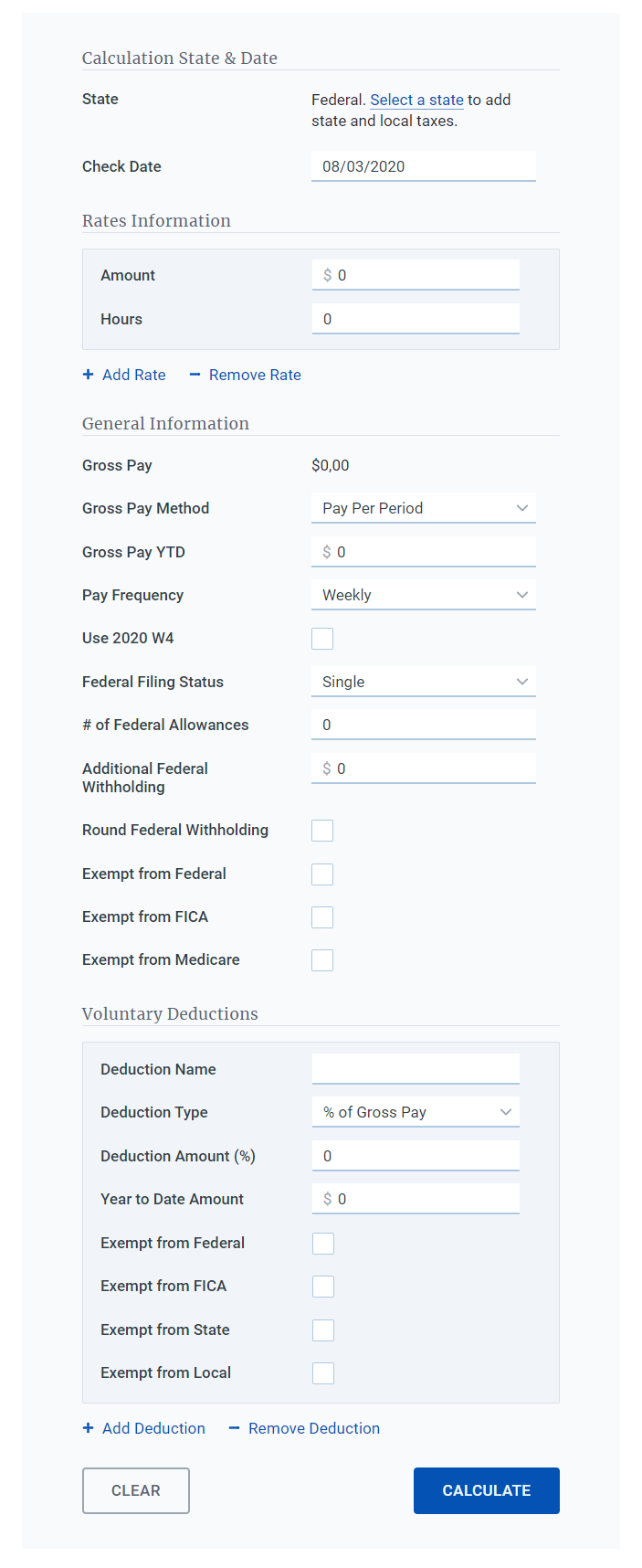

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

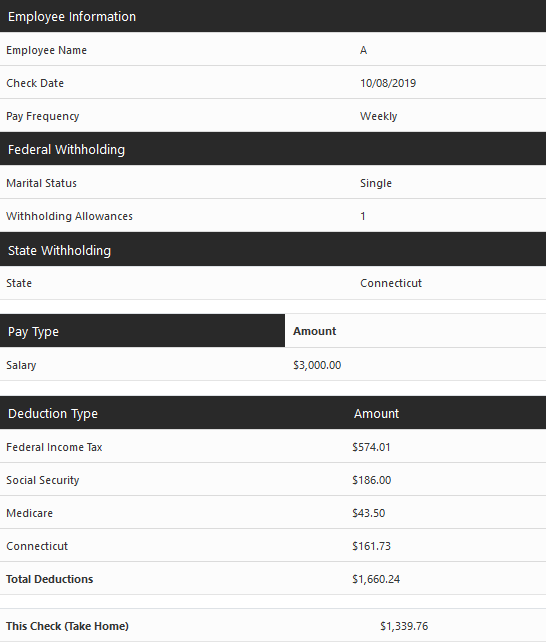

Free Paycheck Calculator Hourly Salary Usa Dremployee

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

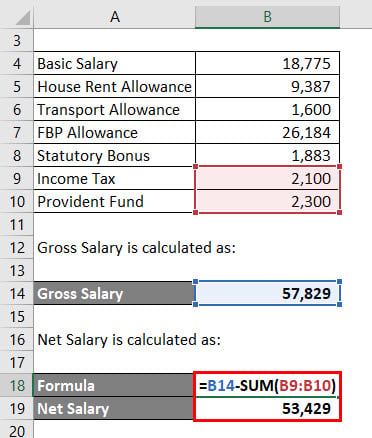

Salary Formula Calculate Salary Calculator Excel Template

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Calculator Free Employee Payroll Template For Excel

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Free Paycheck Calculator Hourly Salary Usa Dremployee

Payroll Calculator Free Employee Payroll Template For Excel

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Free Online Paycheck Calculator Calculate Take Home Pay 2022